Fabulous Tips About How To Claim Self Employment

What can you claim for working from home in 2023?

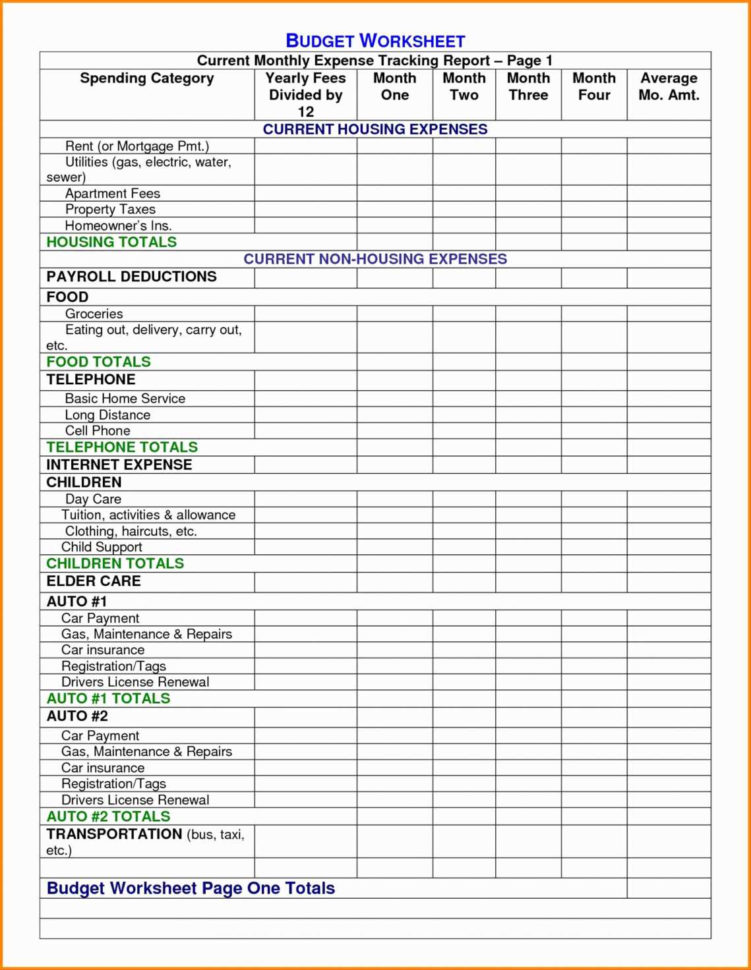

How to claim self employment. You can claim up to $5,110 if you missed work due to being ill or quarantined. As a sole trader, you can. Multiply the number of miles in step 1 by the hmrc mileage allowance rate per mile.

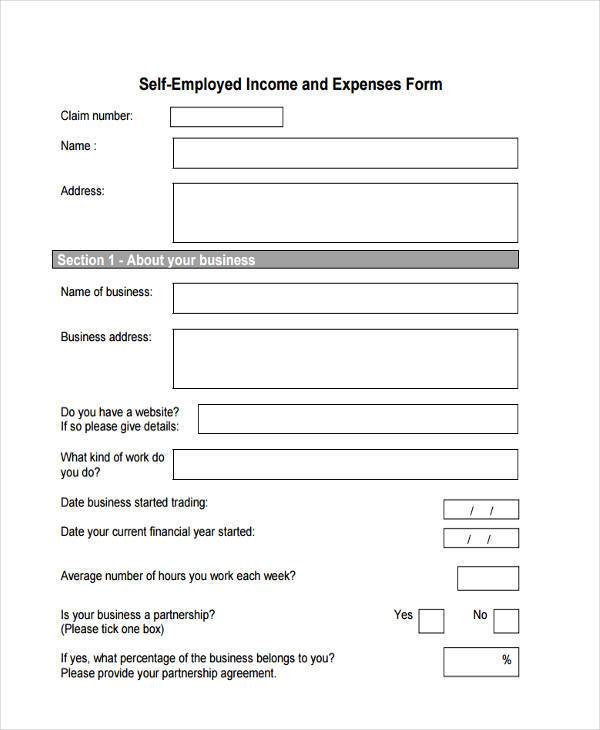

Of course, you don’t want to make up numbers here. If you have claimed the trading income allowance, then you cannot claim any expenses so leave this box blank. Business income includes money you earn from a:

[email protected] blyth workspace, quay road, ne24 3ag. Se tax is a social security and medicare tax primarily for individuals who work for themselves. For the 2022 tax year, the irs approved the following standard mileage rates:

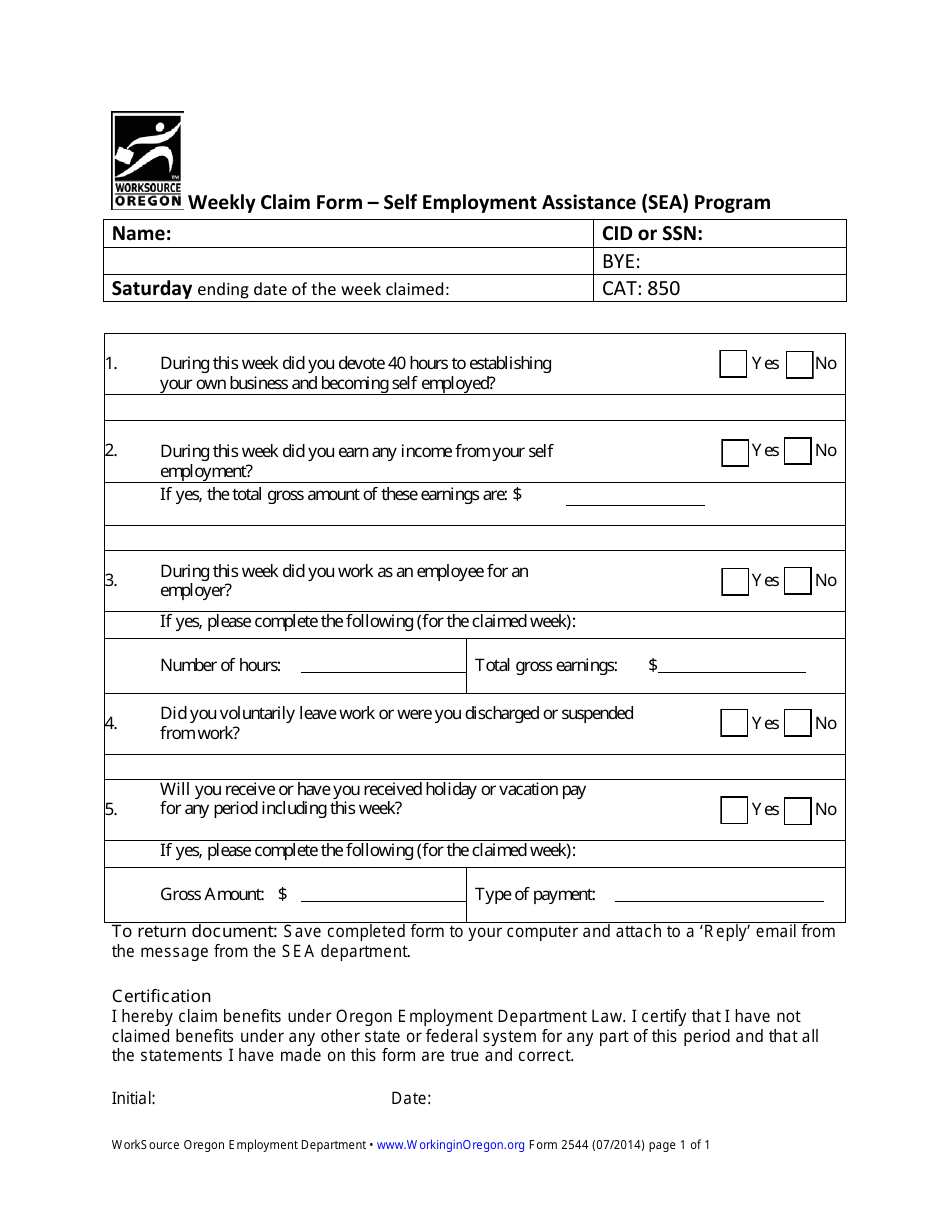

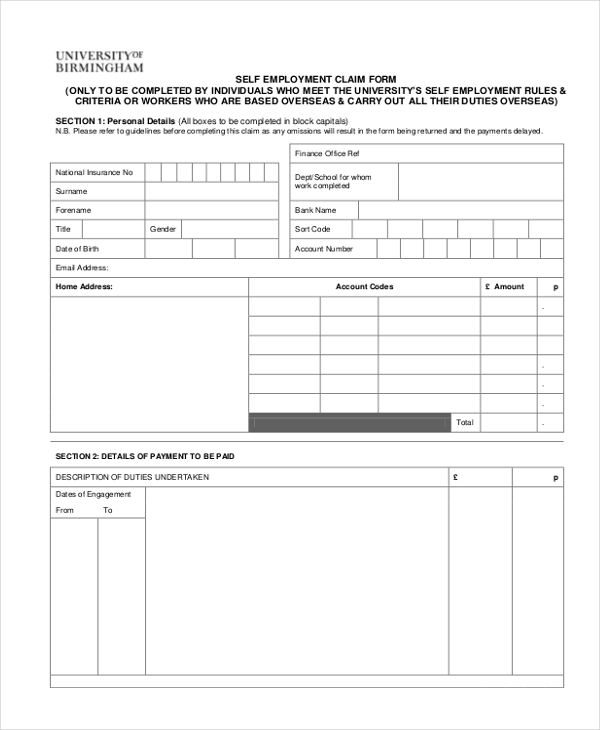

How do i calculate and. Keep accurate usage logs as home office claims often undergo scrutiny. Upload and submit your claim.

Depreciation and section 179 expense deduction: For 2023 the rate is 65.5 cents per mile. Undertaking of any kind, an adventure or.

Add up all your allowable expenses for the tax year and put the total amount on your self. Only include quantifiable data if it is accurate! The rate increases to 67 cents per miles for 2024.

There’s lots to do throughout the.