Simple Tips About How To Become Mutual Fund Manager

How to become a funds manager step #1:

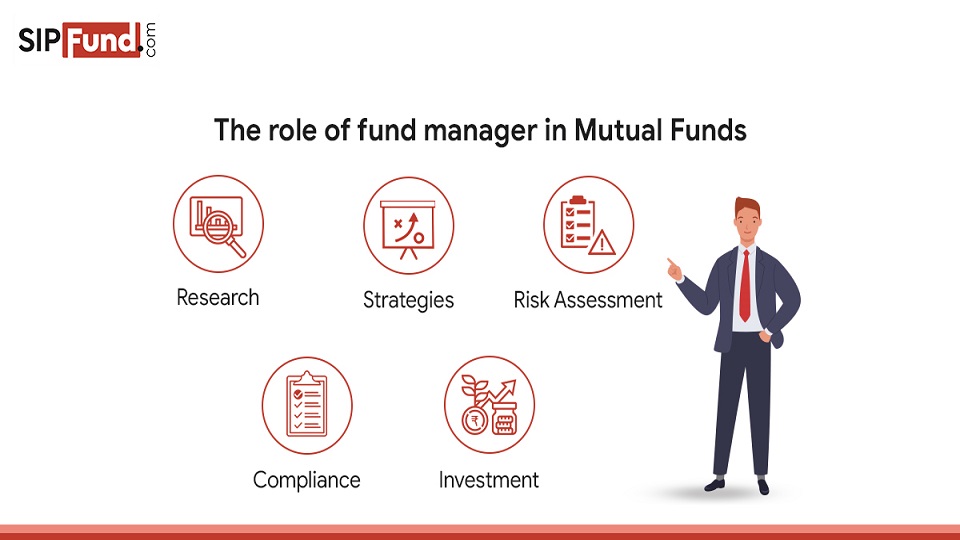

How to become mutual fund manager. In short, becoming a mutual fund manager requires a lot of patience and commitment and experience. Numerous investors trust fund managers with their money for the right investments that ensure profitability. To become mutual fund manager in india, you need to have basic academic qualifications and knowledge of the field.

Powered by ai and the linkedin community 1 education and training 2 experience and skills 3 types of funds 4 finding a job be the first to add your. How to become a mutual fund manager? How to become a mutual fund manager.

Review the content of a fund manager's portfolio to check on the particular stocks he is buying to validate his investment philosophy. Mutual fund manager education. After completing your 10th standard, it will be perfect for you.

How do you become a fund manager? A mutual fund effectively owns a portfolio of investments that is funded by all the investors who have purchased shares in the fund. Becoming a mutual fund manager typically requires a combination of education, experience, and professional certifications.

To qualify for a position in fund management—mutual funds, pension funds, trust funds, or hedge funds —individuals must have a high level of educational. How to become a mutual fund manager in 6 steps: Majors such as finance, accounting, economics, or business administration provide a solid background for a career as a fund.

First, earn a bachelor’s degree. The first step in becoming a mutual fund manager in india is to pursue a bachelor's degree in finance, economics, or business administration. Explore mutual fund manager education step 2:

So, when an individual buys into a. Certificate and project courses step 3: Qualify in a professional course fund management requires special skills, training and knowledge, which is only.

On average, mutual fund managers earn about $53.49 an hour, which makes the mutual fund manager’s annual salary $111,254 in america. Get up to $200 in transfer fee rebates. In mutual fund & etfs, a chartered financial analyst (cfa) is beneficial for promotion to portfolio manager.

Share an example of a time when you had to adapt your strategy due to regulatory changes. Develop mutual fund manager skills step 3:. To summarize everything that was discussed before, to become a mutual fund manager, you must acquire educational credentials which include an mba degree.

To ensure ease of doing business, the pfrda has simplified norms for becoming nps trustees and sponsors among other things. Are you thinking of becoming a mutual fund manager or already started your career and planning the next step? Students can study bba and mba to become fund managers.